Introduction of the new Canada Emergency Rent Subsidy

On November 19, 2020, the Bill C-9 including law articles related to the Canada Emergency Rent Subsidy (« CERS ») and the lockdown support has received the Royal assent. Therefore, companies can apply for the first and second eligible periods, namely from September 27, 2020 to October 24, 2020 and from October 25 to November 21, 2020, on the Website of the Canada Revenue Agency (« CRA »). During the economic announcement in fall 2020 presented on November 30, 2020, the government announced criteria for periods 11, 12 and 13 which remain the same as those of periods 8, 9 and 10.

The purpose of the following description is to highlight the different criteria and particularities of the CERS, including the lockdown support.

Calculation of the base subsidy

The subsidy is calculated by applying a rate to eligible expenses. The subsidy rate to be claimed by the company depends on the drop in eligible revenue that the company experienced, and is calculated as follows:

Revenue drop | Subsidy rate |

70% and more | 65% |

50% to 69% | 40% + (revenue drop (%) - 50 %) X 1.25 |

0% to 49% | Revenue drop (%) X 0.8 |

Eligible period

For the moment, the subsidy applies to eligible expenses of an eligible company, incurred during the following periods:

- September 27 to October 24, 2020;

- October 25 to November 21, 2020;

- November 22 to December 19, 2020;

- December 20, 2020 to January 16, 2021;

- January 17 to February 13, 2021;

- February 14 to March 13, 2021.

After this date but no later than June 30, 2021, the Government could anticipate additional periods with different parameters, which will be subsequently announced.

Eligible companies

Like the Canada Emergency Wage Subsidy (« CEWS »), individuals, companies or trusts subject to tax, non-profit or charity organizations are generally eligible, provided not a public institution. Moreover, the following entities are also eligible to the subsidy:

- Partnerships where at least 50% of the interests in the partnership are held by members eligible to CERS;

- Companies owned by aboriginal governments who run a business;

- Partnerships composed of members eligible to the CERS and some aboriginal governments;

- Registered Canadian amateur athletic associations;

- Registered media organizations;

- Private schools or colleges.

To qualify as eligible, a company must comply with at least one of the three following criteria:

- The company had a CRA company number as of September 27, 2020, or;

- The company had a payroll account as of March 15, 2020, or used a payroll supplier, or;

- Other possible criteria to follow.

Currently, there is no other criteria, but the government may add others during the program.

Calculation of the revenue drop

Like the CEWS, the company will be able to choose between the corresponding month of 2019 method or the alternative method. Once chosen, the method must be the same during the whole program. If the company claims or has already claimed the CEWS for period 5 onwards, the reference period must correspond to the one used for the CEWS. The following table shows the alternatives:

| Reference period | ||

Reference period (coordinated with CEWS) | corresponding month of 2019 method | Alternative method | |

Period 8 September 27 to October 24, 2020 | September and October 2020 compared to September and October 2019, respectively | September and October 2020 compared to average of January and February 2020 | |

Period 9 October 25 to November 21, 2020 | October and November 2020 compared to October and November 2019, respectively | October and November 2020 compared to average of January and February 2020 | |

Period 10 November 22 to December 19, 2020 | November and December 2020 compared to November and December 2019, respectively | November and December 2020 compared to average of January and February 2020 | |

Period 11 December 20, 2020 to January 16, 2021 | December 2020 and January 2021 compared to December 2019 and January 2020, respectively | December 2020 and January 2021 compared to average of January and February 2020 | |

Period 12 January 17 to February 13, 2021 | January and February 2021 compared to January and February 2020, respectively | January and February 2021 compared to average of January and February 2020 | |

Period 13 February 14 to March 13, 2021 | February and March 2021 compared to February and March 2020, respectively | February and March 2021 compared to average of January and February 2020 | |

A CERS application must be filed no later than 180 days after the end of a claim period.

Eligible expenses

The CERS covers expenses incurred during a claim period with regards to a qualifying property. A qualifying property is a business location of the company composed of real or immovable properties in Canada, owned or rented by the company. Besides, the property must be mainly used in the course of ordinary business activities.

As such, the following properties are not qualifying properties:

- A house or other residence used by the shareholder or by non-arm’s-length persons.

- Any owned properties that are primarily used to earn rental income from arm’s-length parties.

The base subsidy rate applies up to a maximum of $75,000 in eligible expenses for each business location, and up to a global maximum of $300,000 in eligible expenses for you and your affiliated entities, if appropriate, per claim period.

To be eligible, the expenses must:

- Be paid to an arm’s-length party;

- Be in respect of the claim period;

- Be paid under a written agreement in place before October 9, 2020 (or a renewal on substantially similar terms or assignment of such an agreement);

- be paid within 60 days of receiving your rent subsidy payment.

Eligible expenses are different if your company rents or owns the qualifying property. For tenants, eligible expenses are fixed or variable rents and include all additional costs paid to the tenant, particularly property taxes.

If the landlord received an amount under the Canada Emergency Commercial Rent Assistance (CECRA) program and they applied the amount to future rent payments, you can still claim the full rent amount in the current period.

For landlords, eligible expenses are property taxes, property insurance and interest on commercial mortgage. The mortgage amount cannot exceed the lesser of the following amounts: the lowest principal amount secured by one or more mortgages on the property at any time it was acquired or the cost amount of the property. Interests could then be limited by this regulation.

Lockdown support

- In addition to the rent subsidy rate, you can receive a lockdown support amount for certain locations affected by public health restrictions. To qualify, the first criterion is to have a base rent subsidy rate of more than 0% for the claim period. Lockdown support is calculated on a location-by-location basis.

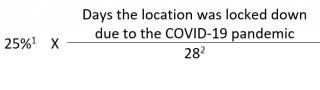

Your CERS top-up (lockdown support) rate is 25% per day on lockdown, calculated as follows:

As mentioned above, to qualify to this additional support, the company must be temporarily closed due to an eligible public health order, which will meet the following conditions:

- be issued by a federal, provincial, or municipal government, or a local health authority;

- be limited based on at least one of factors such as geographical boundaries, type of business or other activity, risks associated with a particular location;

- result in sanctions or be an offence in case of non-compliance;

- be in effect for at least one week;

- require you to stop some or all of your regular activities while the order is in place.

The activities you were not able to carry out must account for at least approximately 25% of total revenues at that location during the prior reference period.

How Mazars can help you

We understand all the challenges related to the Covid-19 pandemic. We can help you determine the eligibility of your company to this new subsidy and support you in the subsequent steps.

For any question regarding the CERS and the eligibility of your company, please contact your Mazars consultant.

Please visit the CRA Website: click here

[1] Fixed top-up rate.

[2] Days in the CERS period.