Are you ready to sell your SME? 5 questions to ask yourself before taking action

1. What is the nature of the sale?

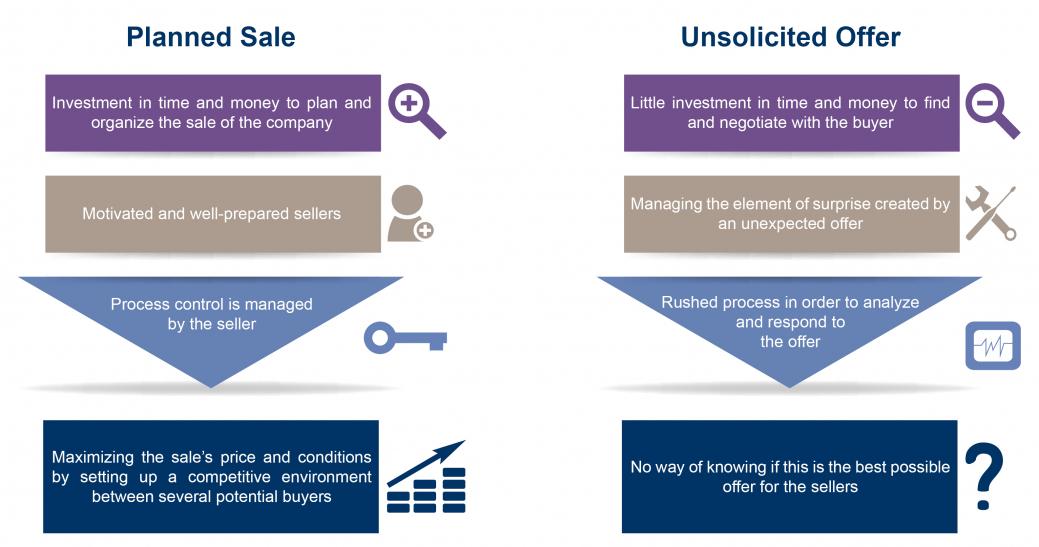

Whether planned or unsolicited, selling your SME may be your first (and last) experience of this kind and the ultimate chance to maximize the investment of a lifetime. First, let’s look at the key characteristics and the possible impact of a planned sale compared to a situation where a seller replies to an unsolicited offer.

2. What are your motivations?

Identifying and understanding the motivations surrounding the sale of your SME is essential to making an informed decision. This is one of the top questions asked by the buyers. Among the most common reasons are:

- age of the shareholder(s);

- pressure from family members and/or the company’s executives;

- financial and/or organizational problems;

- maximum performance achieved with the structure in place;

- desire to undertake new projects;

- death.

3. What are the risks of the sale?

Several risks threaten the sellers before closing a transaction. They need to be identified in order to manage them properly. Among the main risks, we find:

- shareholders and managers who focus too much on the transaction as opposed to managing the company;

- discussions with serious buyers that end abruptly and involve repeating the process with other potential buyers;

- key employees leaving the organization during the process or after the transaction is announced;

- disclosure of inside information to potential buyers who may compete with the seller;

- coping with strong emotions that can compromise an important transaction.

4. What are your expectations?

When you are considering selling your SME, you want to attain specific goals. Needless to say, the chances of reaching these goals are greater through a planned sale. Here are some examples:

- close the initiated transaction;

- maximize the sale’s price;

- minimize representations and warranties;

- maintain the jobs of key and/or loyal employees;

- ensure the company’s continuity (especially in the case of a sale by the founder);

- keep a high level of confidentiality throughout the process.

5. What is the buyer’s position?

The presence of many potential buyers helps to create a competitive environment and contributes to overbidding. However, this involves a great deal of work in order to fully understand the buyers’ goals and also tailor your sales’ pitch according to their expectations. For example, a buyer can value the business for its distribution network while another will focus on its machinery.

The buyer is better positioned to identify and assess the potential synergies and other benefits that would follow the closing of a transaction. In that regard, it is not uncommon to see sellers react strongly to the buyer’s financial benefits as a result of the integration of the companies. Sellers, who are rational and well-prepared, will understand the reasons why the buyer will never offer 100% of the value of these benefits because:

- he assumes the risks of generating profits;

- he assumes the integration costs of the acquired entity;

- he is perhaps one of the only strategic buyers involved;

- he maintains a negotiating range.

By asking yourself these questions, you maximize the chances of making a profitable transaction. In addition, you reduce the risks of making a decision too fast and, above all, based only on intuition and instinct. We are talking here about the investment of a lifetime for most SMEs.

Patrick Whalen, MBA, Vice President – Financial Advisory Services

Note: The masculine form is used throughout this article solely in order to simplify the text.

Also read: How to finance the acquisition of your new assets without using your line of credit?